Our story meets our mission

Viridis was founded with the goal of generating returns on the savings of friends and family, and it maintains that philosophy and approach with all its clients to this day.

Thanks to the best models in the world from various scientific fields, the company grows based on its results, consistently outperforming the market under any circumstances, but always with the same mantra:

We only make money if you do.

— Viridis has nothing to do with normal banks or funds

You can see in real time the profit your money makes, and we don't charge you fixed or hidden commissions. We are still under the idea of helping each other based on trust.

Our methodology

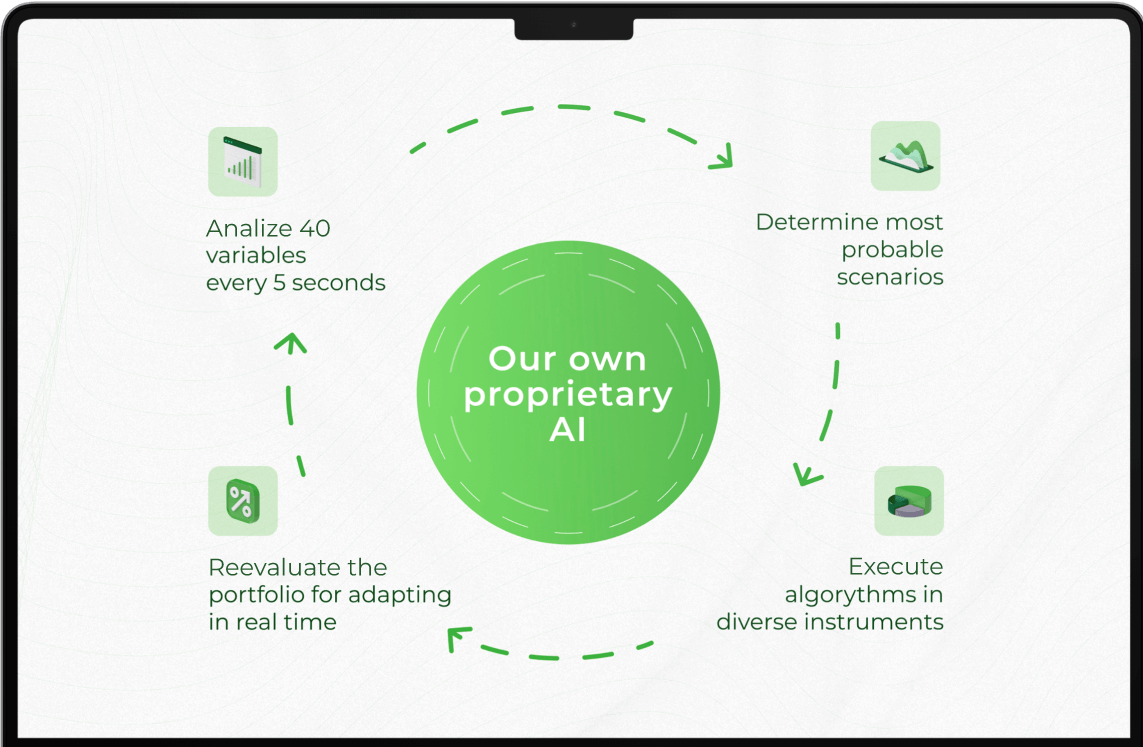

AI CAN SEE FURTHER THAN ANY HUMAN

Utilizing artificial intelligence enables us to monitor dozens of market variables in real time.

This wealth of data empowers us to discern insights beyond the reach of traditional investors employing conventional methodologies.

MACROECONOMIC

VARIABLES

Companies

Valuations

Price

evolution

TECHNICAL

ANALYSIS

TERABYTES OF DATA

TO READ THE MARKET

All this data, combined with over 40 years of comprehensive analysis, enables the AI to comprehend the short, medium, and long-term scenarios of each instrument in which we invest.

EACH SCENARIO HAS

ITS OWN PLAN

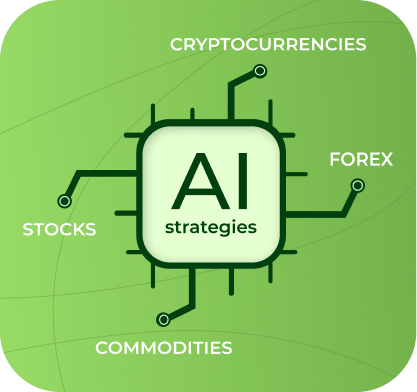

With numerous scenarios across more than 50 different investment instruments

the artificial intelligence determines which assets to invest in, the percentage of your portfolio to expose to manage risk, and the appropriate investment strategy for each asset.

24/7 REAL-TIME ADAPTATION FOR SURVIVAL

However, this isn't sufficient, as the market evolves every second.

That's why AI is capable of tracking every variable affecting each position in your portfolio, monitoring it in real time, and adjusting the portfolio while adhering to all the security measures incorporated into the models.